In the competitive insurance industry, providing excellent customer service and a pleasant experience is crucial to ensuring the success and growth of any company. Among all the brands and companies in this field with an exceptional focus on this aspect, MetLife stands out. With over 150 years of history, they have positioned themselves as one of the top choices in the market.

They have achieved this privileged position by offering great products and solutions and by their strong commitment to providing an exceptional experience to those who trust them to safeguard their interests.

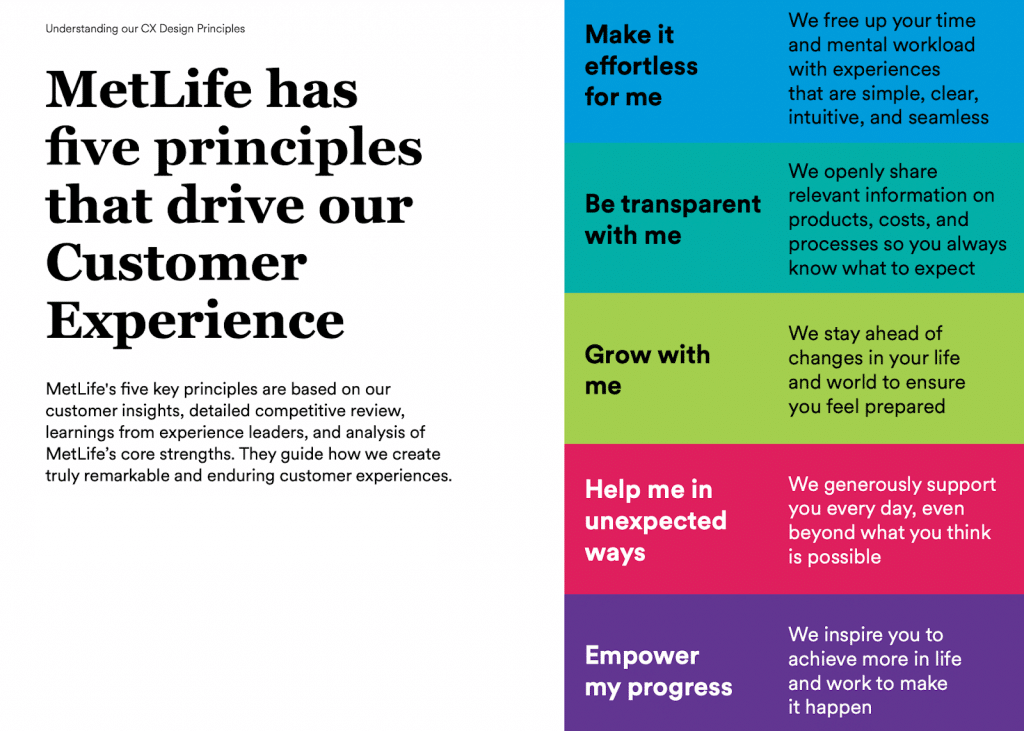

MetLife Customer Experience Design Principles

MetLife has developed an entire methodology to ensure that their staff, products, and initiatives align to achieve customer satisfaction.

These 5 principles are:

- Make it effortless

- Be Transparent

- Grow with me

- Help me in unexpected ways

- Empower my progress

This kind of training and approach has resulted in significant initiatives such as:

- The MetLife Gulf Sales App: An intuitive tablet and desktop application for agents that simplifies complex sales processes and makes them easy to manage.

- Misir Guru: An awareness platform designed for the Bangladeshi audience to understand insurance basics through easily digestible content like text, images, infographics, and comic strips, presented in a colloquial Bangla language tone.

- MetLife Educare: A unique savings and development plan that supports parents in nurturing their children’s development at every stage. It includes structured play classes for toddlers, tutoring and developmental activities for children, and assistance with university selection and admissions for teens.

- MetLife.com: The company’s website displays personalized content for each user based on their location and historical behavior. This feature helps users access relevant content and complete tasks more efficiently.

- MetLife Beautiful: This product is tailored for young single women relocating to the city for work. It offers a health concierge service to help them find the best doctors and includes services such as cosmetic dentistry and other life-enhancing options.

These initiatives showcase how MetLife is using innovative approaches to provide tailored solutions and exceptional experiences to its customers.

Customers who had the best past experiences spent 140% more compared to those who had the poorest experiences

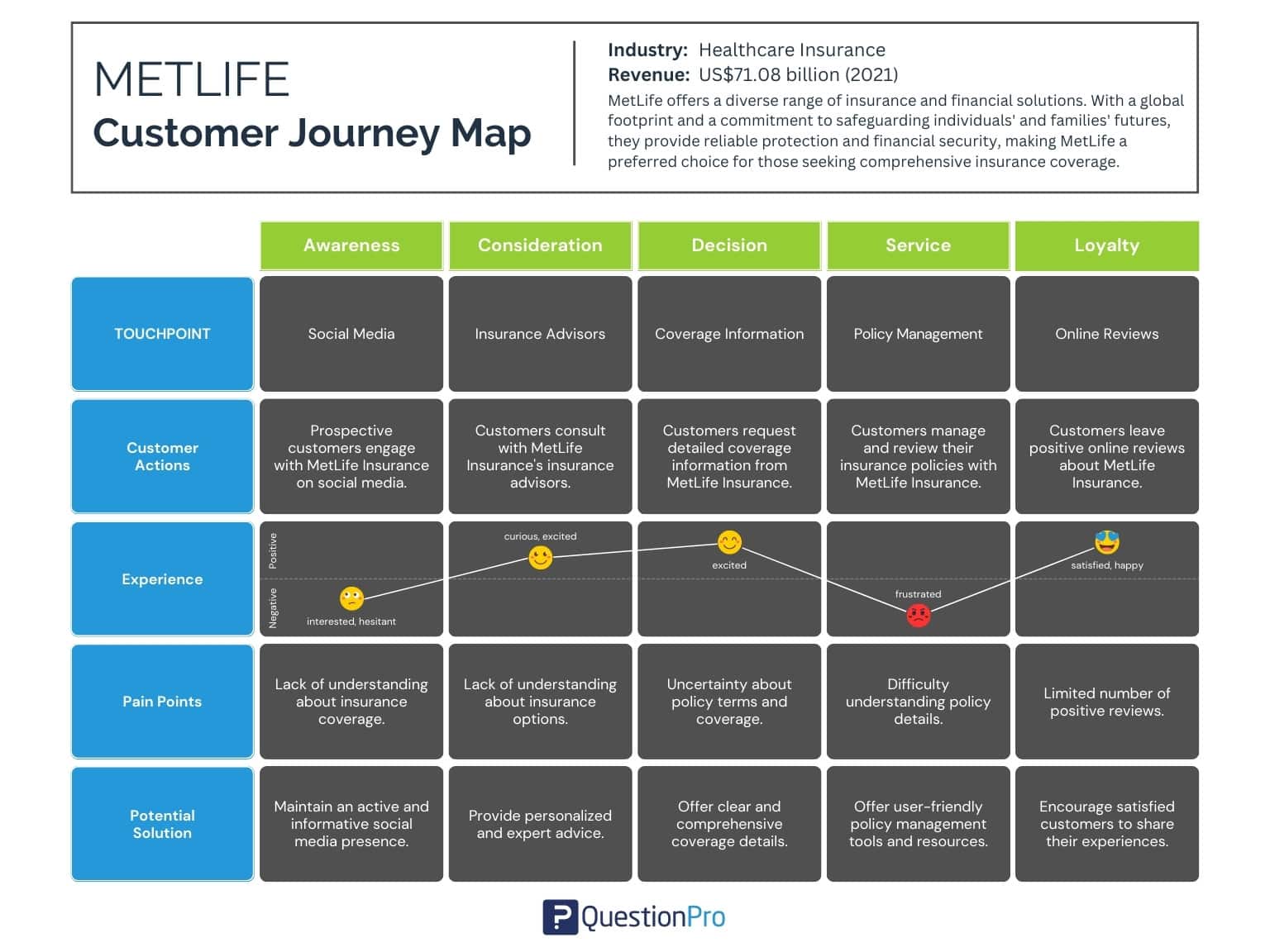

Take a closer look at MetLife’s customer journey map

To gain an even better understanding of how users interact with a company like MetLife and the opportunities that exist to provide exceptional service, we have created a fictional customer journey map based on common touchpoints within this type of industry and including some specific points taken from various communications.

This will allow us to understand better a customer’s journey to discover, consider, and become loyal customers of companies in the insurance industry.

Embark on Enhancing Your Customer Experience

Now that we explored the MetLife customer experience, you can confirm your decision to deliver an exceptional customer experience within the insurance industry. Beyond the benefits we discussed at the beginning of this article, we assure you that a customer experience strategy is one of the best investments you can make as a business leader.

While some might consider this a daunting task, using the right tools can make the process efficient and effective.

At QuestionPro, we’ve developed a range of solutions that cater to the needs of various companies, regardless of size or industry.

Within our extensive array of functions and tools, you can find our powerful customer journey mapping tool called SuiteCX. With just a few clicks, you can create a customer journey tailored to your company. Moreover, you can enrich it with real data and buyer personas that align with your target audience, providing a clearer perspective of your business’s real situation and identifying potential opportunities.

Additionally, QuestionPro CX offers you the chance to understand your customers’ perceptions and identify pain points that can transform into significant loyalty and promotion opportunities. Within our customer experience management software, you can monitor every touchpoint of your customer journey and collect real-time information to prevent customer attrition and provide excellent experiences to all your clients.

Stage 01: AWARENESS

| Touchpoint | Activity | Pain Point | Solution |

| Online Advertising | Prospective customers discover MetLife Insurance through online ads. | Limited knowledge about available insurance options. | Run targeted online advertising campaigns. |

| Social Media | Prospective customers engage with MetLife Insurance on social media. | Lack of understanding about insurance coverage. | Maintain an active and informative social media presence. |

| Industry Webinars | Prospective customers attend MetLife Insurance’s insurance webinars. | Lack of understanding about insurance topics. | Host informative webinars to educate customers. |

| Referrals | Prospective customers hear about MetLife Insurance from friends or family. | Lack of personal recommendations. | Encourage satisfied customers to refer others. |

Stage 02: CONSIDERATION

| Touchpoint | Activity | Pain Point | Solution |

| Website | Customers explore MetLife Insurance’s website for insurance information. | Confusion about available insurance products and coverage. | Design a user-friendly website with clear information. |

| Comparing Plans | Customers compare MetLife Insurance’s insurance plans with other providers. | Concerns about premiums, coverage, and benefits. | Highlight competitive advantages and benefits. |

| Insurance Advisors | Customers consult with MetLife Insurance’s insurance advisors. | Lack of understanding about insurance options. | Provide personalized and expert advice. |

| Customer Support | Customers reach out to MetLife Insurance’s customer support. | Frustration with unhelpful or slow customer support. | Provide efficient and knowledgeable customer service. |

Stage 03: PURCHASE

| Touchpoint | Activity | Pain Point | Solution |

| Policy Application | Customers apply for insurance policies with MetLife Insurance. | Lengthy and complicated application process. | Simplify application procedures and paperwork. |

| Coverage Information | Customers request detailed coverage information from MetLife Insurance. | Uncertainty about policy terms and coverage. | Offer clear and comprehensive coverage details. |

| Premium Payment | Customers make premium payments for their insurance policies. | Challenges in making timely payments. | Offer convenient and flexible payment options. |

| Customized Plans | Customers work with MetLife Insurance to create personalized insurance plans. | Difficulty finding suitable coverage. | Develop customized insurance solutions based on needs. |

| Policy Review | Customers review and update their insurance policies with MetLife Insurance. | Lack of clarity about policy changes. | Provide clear policy review and update processes. |

Stage 04: USAGE

| Touchpoint | Activity | Pain Point | Solution |

| Claims Processing | Customers file and process insurance claims with MetLife Insurance. | Complicated or slow claims processing. | Streamline claims processing and improve communication. |

| Policy Management | Customers manage and review their insurance policies with MetLife Insurance. | Difficulty understanding policy details. | Offer user-friendly policy management tools and resources. |

| Renewals | Customers renew their insurance policies with MetLife Insurance. | Confusion about renewal terms and costs. | Clearly communicate renewal options and benefits. |

| Customer Support | Customers contact MetLife Insurance’s customer support for assistance. | Frustration with unhelpful or slow customer support. | Enhance customer support with knowledgeable agents. |

Stage 05: LOYALTY

| Touchpoint | Activity | Pain Point | Solution |

| Loyalty Programs | Customers enroll in MetLife Insurance’s loyalty programs. | Unclear benefits or rewards of loyalty programs. | Clearly communicate the advantages of loyalty programs. |

| Personalized Offers | Customers receive personalized insurance offers from MetLife Insurance. | Receiving irrelevant or uninteresting offers. | Tailor offers based on customer needs and preferences. |

| Newsletter | Customers receive regular insurance updates and tips from MetLife Insurance. | Lack of information about policy changes. | Communicate policy updates and relevant information. |

| Financial Planning | Customers receive financial planning services from MetLife Insurance. | Challenges in managing personal finances. | Offer comprehensive financial planning solutions. |

Stage 06: ADVOCACY

| Touchpoint | Activity | Pain Point | Solution |

| Online Reviews | Customers leave positive online reviews about MetLife Insurance. | Limited number of positive reviews. | Encourage satisfied customers to share their experiences. |

| Social Media Engagement | Customers engage with MetLife Insurance on social media. | Lack of engagement and interaction. | Foster active and meaningful social media interactions. |

Elevate Your Customer Experience!

In a dynamic and competitive industry like insurance, customer experience becomes a paramount concern for companies within this field. That’s why companies must go beyond mere products or services; they must cultivate exceptional customer experiences and delight their clients to enjoy numerous benefits.

At QuestionPro, we have developed a range of features and solutions to help you take action to generate outstanding experiences.

QuestionPro CX, our customer experience management software, empowers you with a holistic perspective by utilizing data-driven insights. You can gain a deep understanding of customer sentiment and patterns through real-time analytics. Discover which aspects of your offerings resonate most with your audience and pinpoint areas needing improvement.

Take a step towards enhancing your customer experience and witness the transformative impact on your bottom line. Your customers deserve nothing less, and your business deserves nothing less than excellence.