In the competitive world of the insurance industry, where the level of attention and delight given to customers defines a company’s success, the AXA customer experience stands out for its strong customer focus and informed decision-making, allowing it to provide a level of service that few in the industry can boast.

Through co-creation, innovation, and unwavering dedication, AXA consistently sets new benchmarks in enriching the customer experience, transforming lives, and shaping the future of the industry.

This is why we decided to explore some of their most innovative initiatives and learn what makes this company one of the most recognized globally. In this article, we’ll delve into AXA’s Customer Experience Strategy and the methodologies they use to achieve such success.

Why is AXA Known?

AXA is a global multinational insurance and financial services company headquartered in Paris, France. With a rich history dating back to the 19th century, AXA has grown to become one of the largest and most prominent players in the insurance industry on a global scale. The company operates in various segments, including life insurance, property and casualty insurance, health insurance, and asset management.

Beyond its core insurance offerings, for the AXA customer experience, the company has embraced a customer-centric approach that focuses on co-creating solutions to address the evolving needs of its customers. The company places strong emphasis on innovation, blending cutting-edge technology with human ingenuity to deliver services that are both efficient and compassionate. AXA’s dedication to customer experience and innovation has contributed to its reputation as a leader in the insurance sector.

What Makes the AXA Customer Experience Strategy Unique?

The axiom “the customer is at the heart of all we do” encapsulates AXA’s core philosophy. Partnering harmoniously with business collaborators, AXA co-creates solutions that seamlessly align with the ever-shifting needs of their customers. The contemporary consumer plays myriad roles – from intrepid travelers to diligent professionals and discerning consumers – each role necessitating tailored services. AXA’s potency resides in its ability to envision and actualize these bespoke solutions.

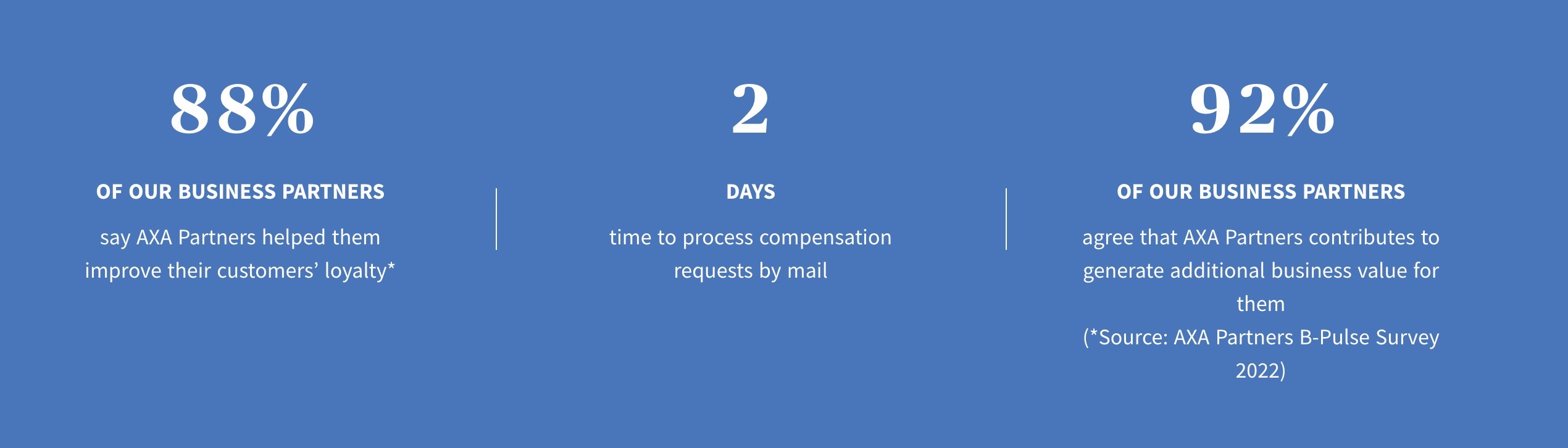

Success is quantifiable, and for AXA, it reflects in resounding numbers. An impressive 88% of business partners attest that AXA Partners has fortified their customers’ loyalty. The testament to AXA’s customer-centric commitment is underscored by the swift 2-day processing time for compensation requests sent by mail. Equally remarkable, 92% of business partners acknowledge AXA Partners’ role in generating additional business value (*Source: AXA Partners B-Pulse Survey 2022).

The innovation ethos propels AXA beyond the present into a realm of tailored experiences interwoven with customers’ journeys. Amidst the digital transformation sweeping the globe, AXA collaborates with business partners to forge services attuned to customers’ evolving needs and expectations. This endeavor births not just services but an expedition – an extraordinary customer journey cultivated by a network of experts within the AXA group.

One of the great successes is that they have perfectly identified each touchpoint their customers go through and pay special attention to each one of them. This journey, steeped in consumer-centricity, culminates in amplified partner growth, heightened customer satisfaction, and unwavering loyalty.

To better illustrate how a hypothetical customer journey map of AXA would look, we’ve created one using the most common customer touchpoints within the industry, incorporating others shared on their social media and website.

AXA Customer Journey Map Example

The AXA Customer Journey Map includes many crucial touchpoints for any company within this industry. We’ve also included some situations that customers experience and possible solutions to implement to turn those pain points into opportunities that lead us to a base of satisfied and loyal customers.

Stage 01: AWARENESS

| Touchpoint | Activity | Pain Point | Solution |

| TV Commercials | Prospective customers see AXA Insurance ads on TV. | Lack of awareness about AXA’s insurance services. | Run engaging and informative TV advertising campaigns. |

| Digital News | Prospective customers discover AXA Insurance through online news articles. | Limited knowledge about available insurance options. | Collaborate with news outlets for featured coverage. |

| Social Media Engagement | Prospective customers engage with AXA Insurance on social media. | Lack of understanding about insurance coverage. | Maintain active and informative social media presence. |

Stage 02: CONSIDERATION

| Touchpoint | Activity | Pain Point | Solution |

| Website | Customers explore AXA Insurance’s website for insurance information. | Confusion about available insurance products and coverage. | Design a user-friendly website with clear information. |

| Customer Testimonials | Customers read testimonials about AXA Insurance from existing clients. | Uncertainty about the quality of insurance. | Showcase positive customer experiences and reviews. |

| Comparison Tools | Customers use online tools to compare AXA Insurance with other providers. | Concerns about premiums, coverage, and benefits. | Provide an easy-to-use online comparison feature. |

| Insurance Advisors | Customers consult with AXA Insurance’s insurance advisors. | Lack of understanding about insurance options. | Provide personalized and expert advice. |

| Customer Support | Customers reach out to AXA Insurance’s customer support. | Frustration with unhelpful or slow customer support. | Provide efficient and knowledgeable customer service. |

Stage 03: DECISION

| Touchpoint | Activity | Pain Point | Solution |

| Online Application | Customers apply for insurance policies through AXA Insurance’s website. | Lengthy and complicated application process. | Simplify the online application process. |

| Policy Details | Customers receive detailed policy information from AXA Insurance. | Uncertainty about policy terms and coverage. | Offer clear and comprehensive policy details. |

| Flexible Payment | Customers choose convenient payment options for their insurance policies. | Challenges in making timely payments. | Provide flexible and convenient payment choices. |

| Customized Coverage | Customers work with AXA Insurance to create tailored insurance plans. | Difficulty finding suitable coverage. | Develop personalized insurance solutions based on needs. |

| Policy Review | Customers review and update their insurance policies with AXA Insurance. | Lack of clarity about policy changes. | Provide clear policy review and update processes. |

Stage 04: USAGE

| Touchpoint | Activity | Pain Point | Solution |

| Claims Processing | Customers file and process insurance claims with AXA Insurance. | Complicated or slow claims processing. | Streamline claims processing and improve communication. |

| Digital Policy Management | Customers manage and review their insurance policies online. | Difficulty understanding policy details. | Offer user-friendly online policy management tools. |

| Easy Renewal | Customers seamlessly renew their insurance policies with AXA Insurance. | Confusion about renewal terms and costs. | Clearly communicate renewal options and benefits. |

| Support and Assistance | Customers contact AXA Insurance’s customer support for assistance. | Frustration with unhelpful or slow customer support. | Enhance customer support with responsive agents. |

Table 05: LOYALTY

| Touchpoint | Activity | Pain Point | Solution |

| Loyalty Programs | Customers enroll in AXA Insurance’s loyalty programs. | Unclear benefits or rewards of loyalty programs. | Clearly communicate the advantages of loyalty programs. |

| Personalized Offers | Customers receive tailored insurance offers from AXA Insurance. | Receiving irrelevant or uninteresting offers. | Customize offers based on customer preferences. |

| Customer Feedback | Customers provide feedback and suggestions to AXA Insurance. | Limited channels for voicing opinions. | Encourage and value customer feedback for improvement. |

| Financial Guidance | Customers access financial planning services from AXA Insurance. | Challenges in managing personal finances. | Offer comprehensive financial planning assistance. |

Stage 06: ADVOCACY

| Touchpoint | Activity | Pain Point | Solution |

| Referral Incentives | Customers refer friends and family to AXA Insurance. | Lack of incentives for referrals. | Reward customers for successful referrals. |

| Positive Reviews | Customers leave glowing online reviews about AXA Insurance. | Limited number of positive reviews. | Encourage satisfied customers to share their experiences. |

| Engaging Social Presence | Customers interact with AXA Insurance on social media. | Lack of engagement and interaction. | Foster interactive and informative social media presence. |

Ready to Start Improving Your Customer Experience?

In this article, we’ve mentioned some of the AXA customer experience and its great achievements in an area in which they have excelled due to their efforts and business philosophy. However, these successes and strategies are not exclusive to large companies or companies within the insurance industry; it’s an approach that all businesses should adopt to enjoy the multiple benefits of a good CX strategy.

At QuestionPro, we have the ideal tools and features to help you take action in transforming your customer experience. Within our wide range of options, you’ll find our customer journey mapping tool that will allow you to easily and attractively create your own journey map in just a few clicks.

You’ll also discover a series of features developed to efficiently manage each point of your customer journey and always stay attentive to what’s happening in your business and the satisfaction level of your audience, finding opportunities that set you apart from your competition.

Start today by contacting our team and discovering the benefits of QuestionPro CX, your best ally in improving your customer experience.