Customer churn is when customers cease their relationship with a company or business, typically by discontinuing their use of its products or services. It is a significant concern for businesses across various industries, including telecommunications, software, e-commerce, and subscription-based services.

Customer churn is a crucial metric impacting a company’s profitability and growth. Losing existing customers leads to revenue decline and incurs costs associated with acquiring new customers to replace the lost ones. High customer churn can also damage a company’s reputation and hinder its long-term sustainability.

What is Customer Churn?

Customer churn (attrition or turnover) is when customers stop doing business with a company over a specific period. A high churn means that a higher number of customers no longer want to purchase goods and services from the business.

Customer churn rate or customer attrition rate is the mathematical calculation of the percentage of customers who are not likely to make another purchase from a business. It happens when customers decide to not continue purchasing products/services from an organization and end their association.

Customer churn is an integral parameter for the organization since acquiring a new customer could cost almost 7 times more than retaining an existing customer. Customer churn can prove to be a roadblock for an exponentially growing organization and a customer retention strategy should be decided in order to avoid an increase in churn rates.

Importance of Predicting Customer Churn

The ability to be able to predict that a certain customer is at a very high risk of churning, while there is still some time to do something significant about it, itself represents a great additional potential revenue source for any business.

- It’s a fact acquiring new customers is a costly affair but losing the existing customers will cost even more for the business or the organization. As existing paying customers are usually returning customers who if happy will purchase repeatedly from your brand.

- The competition in any market is on a rise and this encourages organizations to focus not only on new business but also on retaining existing customers.

- The most essential step toward predicting customer churn is to start awarding existing customers for constant purchases and support.

- An entire customer journey leads to customer churn and not just a few incidents. Due to the priority of avoiding customer churn, organizations should start offering incentives for purchases of these soon-to-churn customers.

- As mentioned earlier, a customer’s intention to stop using a particular product/service may always be a decision formed over time. There are various factors that lead to this decision and it’s important for organizations to understand each and every factor so that customers can be convinced to stay and keep making purchases. This can be done by constantly conducting customer satisfaction surveys and analyzing the received feedback.

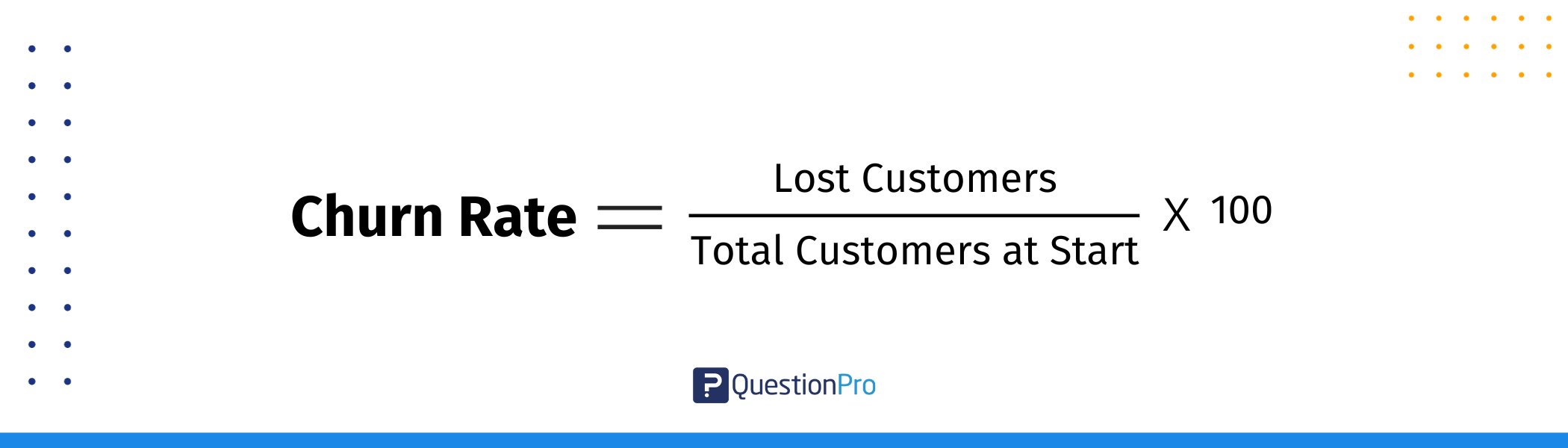

Customer Churn Rate Calculation

In the simplest form, the customer churn rate is the number of customers you have lost divided by the total number of customers. To have an estimate you can segment your customers on the basis of the frequency of their purchase.

Customer Churn Rate = No. of Customers lost/Total no. of customers (Period) x 100

The application of this formula for one iteration is simple, however, it is more complicated when you have to calculate churn over multiple time periods.

For example in the first year, the number of customers lost is 5 and the total number of customers is 100 then for the first year your churn rate is 5/100*100= 5%.

However, even with a constant customer churn rate, revenue loss is incremental in nature.

Customer Churn Calculation Example

For example, if you acquire 10 customers every year who purchase $100 worth of goods and service, over 3 years at 0% churn rate, you will be making ($100 X 10) + ($100 X 20) + ($100 X 30) = $6000.

However, things get more complicated when average churn rate kicks in. Now let’s take an average business churn rate of 30% and suddenly you have ($100 X 10) + ($100 X 17) + ($100 X 21.1) = $4810.

In other words, the churn cost the business $ 1,190, which over 3 years cost the company about 20% of overall revenue. This lost revenue due to customer churn is called revenue churn.

Most businesses spend a significant sum of money on acquiring new customers but very less focus goes into ensuring that customers continue to make repeat purchases. Some experts even suggest that more focus needs to go into higher customer retention rate and lower churn rate as a business grows.

Moreover, higher churn has a visibly negative impact on a business for the following reasons as well:

- The cost of acquiring new customers is significantly higher than retention costs.

- The rate of selling to an existing customer is at an average 60% higher than selling to a customer who is not familiar with your brand.

- Existing customers, when satisfied, are an excellent source for brand promotions through the organic spread of “word of mouth”. In other words, they become your brand promoters and recommend your brand to others, thereby increasing your overall customer base without you having to spend more on customer acquisition.

So for any business to make incremental profits, it is critically important to have a low churn and high customer satisfaction rate.

Customer Churn Analysis

Now that we have a good understanding of what customer churn is, the next obvious step is to analyze it. There are two reasons for this:

1. Before you want to find solutions to improve your churn rate you should know what is causing it in the first place.

2. If you have implemented a solution to reduce the churn then you should know if it’s working or not.

There are many ways to track and analyze churn, here we will focus on two methods: cohort Study report, and churn by customer behavior.

1. Cohort Report

A cohort report analyzes units of your customers and their churn rate over time. A cohort is a unit or a segment of customers who purchased from your brand in a certain time frame. A common cohort that can be used is customers who made purchases in a particular month, for example, your January 2018 cohort will be the customers who closed that month.

There are two major advantages of a cohort report: it produces clean numbers, not influenced by new customer acquisition and the second major benefit is that it helps you identify a pattern in the customer churn.

2. Churn by behavior

In addition to analyzing churn by the cohort report, you can also analyze churn by observing customer behavior. What this means is you need to observe a certain customer behavior pattern of using certain features or completing a certain purchase action and determine its impact on the churn.

This method has advantages like:

- Businesses may decide to focus on products and features that need improvement to reduce customer churn.

- Brands can also focus on making the already existing features better than retaining the customers.

How to Reduce Customer Churn Using 6 Simple Ways

1. Track your Net Promoter Score

Net Promoter Score not only helps you identify your loyal customers (Promoters) but also the dissatisfied ones (Detractors). You can reduce your churn by tracking your NPS score.

2. Customer Effort Score (CES)

Customer Effort Score (CES) is a type of customer satisfaction survey metric that helps you understand your customer effort. Lesser the customer effort score better your customer service. With better customer service customer churn ought to be lower.

3. Ask your customers the right questions

Customer is the king and rightly said. For a business, it is extremely important to know if its customers are satisfied with its products or services. The easiest way to know that takes a quick customer satisfaction feedback.

Ask your customers the right questions to get the right feedback, which will ultimately help you make informed decisions/ timely changes (if needed) thereby reducing the number of dissatisfied customers.

4. Keep your loyal customers happy

Give your loyal customers reasons to stick around with your brand. Loyal customers not only buy regularly from you but also suggest their family, friends, and business associates to you. Offer loyalty or reward points, birthday/anniversary discounts reward points that can be redeemed, etc.

5. Offer more than usual to your loyal customers

Offer them long-term discounts. A long-term discount or contract should benefit both, the business and the customer. Leading footwear offers a customer lifetime exchange offer on their shoes provided the shoes are still in good condition. Who would want to miss such an offer?

6. Provide exceptional customer service

Make it impossible for your customers to go to your competitors. Customer service is the key to customer loyalty. If a brand provides exceptional customer service there are fewer chances of churn. Be better than your competitors. You don’t just sell a product, make sure you add value to it too!

For example: A company is facing the loss of customers frequently, and they perceive that this churn is happening because of pricing and not customer service. However, according to a recent study, it was observed that most companies feel that their customer service is good but their pricing is the issue, whereas the case is the opposite. As per the survey conducted with these customers, it was concluded that 40% left because of customer service and only 29% because of pricing.

Hence this shows that monitoring and keeping your customers happy is what will enable a company to retain customers or even win back the lost customers. Thus, a customer loss survey is needed and can be very helpful to find out why the customers are leaving and what areas need to be improved on the basis of data gathered directly from their customers.

Advantages of Customer Churn Prevention

- Gain information for improvement: Dissatisfied customers are a source of constructive feedback for an organization’s betterment. An organization will gain information about aspects that need to be improved while implementing strategies to prevent churn.

- Reduce the risk of business: Customer churn indicates a direct loss to the business. Selling a new product/service to an existing customer will be much easier than selling it to a new customer. Thus, churn can be harmful to the growth of the business.

- Understand the target market: Constantly working towards the reduction of customer churn will uncover layers of the market which were otherwise unknown. Surveys focus groups and other such activities can be carried out to know the target market in a better manner and in turn reduce churn.

- Build a competitive advantage in the market: In a world where there is constant competition to attain new customers and retain existing ones, having an edge over the competition is important. In the process of reducing churn, not only do customers know unknown aspects of a business but also build a competitive advantage over the others in the market.

Ready to close the gap? Spark joy with your customers and learn about our customer experience program. Let us guide you towards your first step into the building and simplifying your CX program.

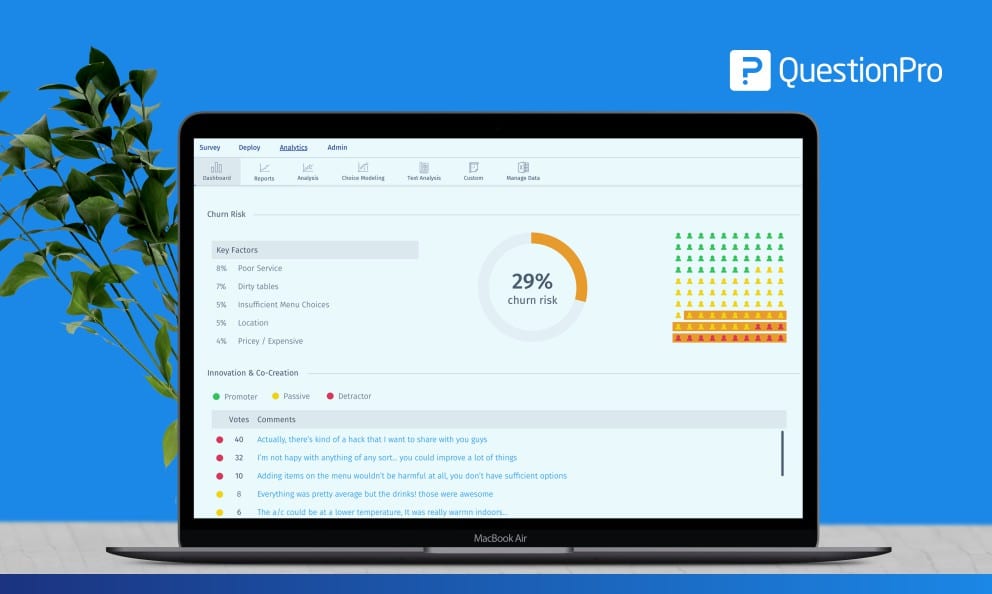

How QuestionPro CX can Help to Improve Customer Churn?

QuestionPro CX is a powerful tool for improving customer churn by enabling businesses to track, analyze, and act on customer feedback and sentiment. Here’s how it can help reduce churn:

1. Real-Time Feedback

QuestionPro CX gathers instant customer feedback through customizable surveys triggered by actions like purchases or service interactions. It helps businesses quickly assess satisfaction at crucial moments.

2. NPS Tracking

Businesses can monitor loyalty by regularly tracking Net Promoter Scores (NPS). Automated follow-ups with detractors help resolve issues before they lead to churn.

3. Customer Journey Mapping

Mapping customer journeys with QuestionPro CX highlights high-risk touchpoints. Closed-loop feedback ensures customers feel heard, reducing dissatisfaction and churn.

4. Predictive Churn Analytics

QuestionPro CX uses predictive analytics to identify customers at risk of leaving, allowing for targeted retention strategies like personalized outreach or special offers.

5. Actionable Insights for Teams

Teams get real-time insights and alerts to act quickly when customer satisfaction drops or churn risk increases, enabling proactive retention efforts.

With these features, QuestionPro CX empowers businesses to proactively address customer needs, improving satisfaction and reducing churn through data-driven, timely interventions.

Conclusion

Customer churn is a critical aspect of business operations, and understanding its causes and implementing effective strategies to mitigate it is essential for long-term success. QuestionPro, a customer feedback and survey platform, plays a significant role in helping businesses address churn.QuestionPro empowers businesses with the tools and insights necessary to address churn effectively.

By leveraging its survey capabilities, pricing analytics, analytics tools, and predictive modeling, companies can better understand their customers, develop targeted retention strategies, and ultimately reduce customer churn rates, leading to improved customer satisfaction, increased revenue, and sustainable growth.

Frequently Asked Questions( FAQs)

Customer churn (attrition or turnover) is when customers stop doing business with a company over a specific period.

Customer churn is a problem because it leads to lost revenue and increased acquisition costs and can signal dissatisfaction with a product or service.

High churn also affects a company’s growth and stability, making it harder to build long-term customer relationships.

A Good Customer Churn rate is typically low, around 5% to 7% annually for most industries. A low churn rate means customers are staying loyal, which is key for long-term business success.