Trust is everything when choosing a bank. But what truly defines trust? Beyond reputation, the overall customer experience—the ease of transactions, quality of support, and financial tools—simplifies life. But how can we quantify all these aspects? The answer is simple: Net Promoter Score (NPS).

NPS is a widely used metric that measures customer loyalty and satisfaction. In this article, we’ll break down JPMorgan Chase & Co.’s NPS, analyze its importance, and explore how it compares to competitors in the banking sector. Plus, we’ll share key takeaways to help businesses refine their customer experience strategies.

What is NPS and Why Does It Matter?

Net Promoter Score (NPS) is a simple yet powerful indicator of customer sentiment used across industries to monitor satisfaction levels. It’s based on one straightforward question:

“On a scale of 0–10, how likely are you to recommend us to a friend or colleague?”

Customers fall into three categories based on their responses:

- Promoters (9–10): Loyal, enthusiastic advocates.

- Passives (7–8): Satisfied but not particularly loyal.

- Detractors (0–6): Unhappy customers who may discourage others from using the service.

Once responses are collected and categorized, Net Promoter Score is calculated using the following formula:

NPS = % Promoters – % Detractors

A high NPS suggests strong customer loyalty, while a low score signals potential service or reputation issues. But how does JPMorgan Chase & Co. perform in this evaluation? Let’s take a closer look.

JPMorgan Chase & Co.’s NPS Breakdown

JPMorgan Chase & Co. has an impressive NPS of 43.

JPMorgan

Chase & Co NPS:

43

Customer sentiment distribution:

- Promoters: 64%

- Passives: 15%

- Detractors: 21%

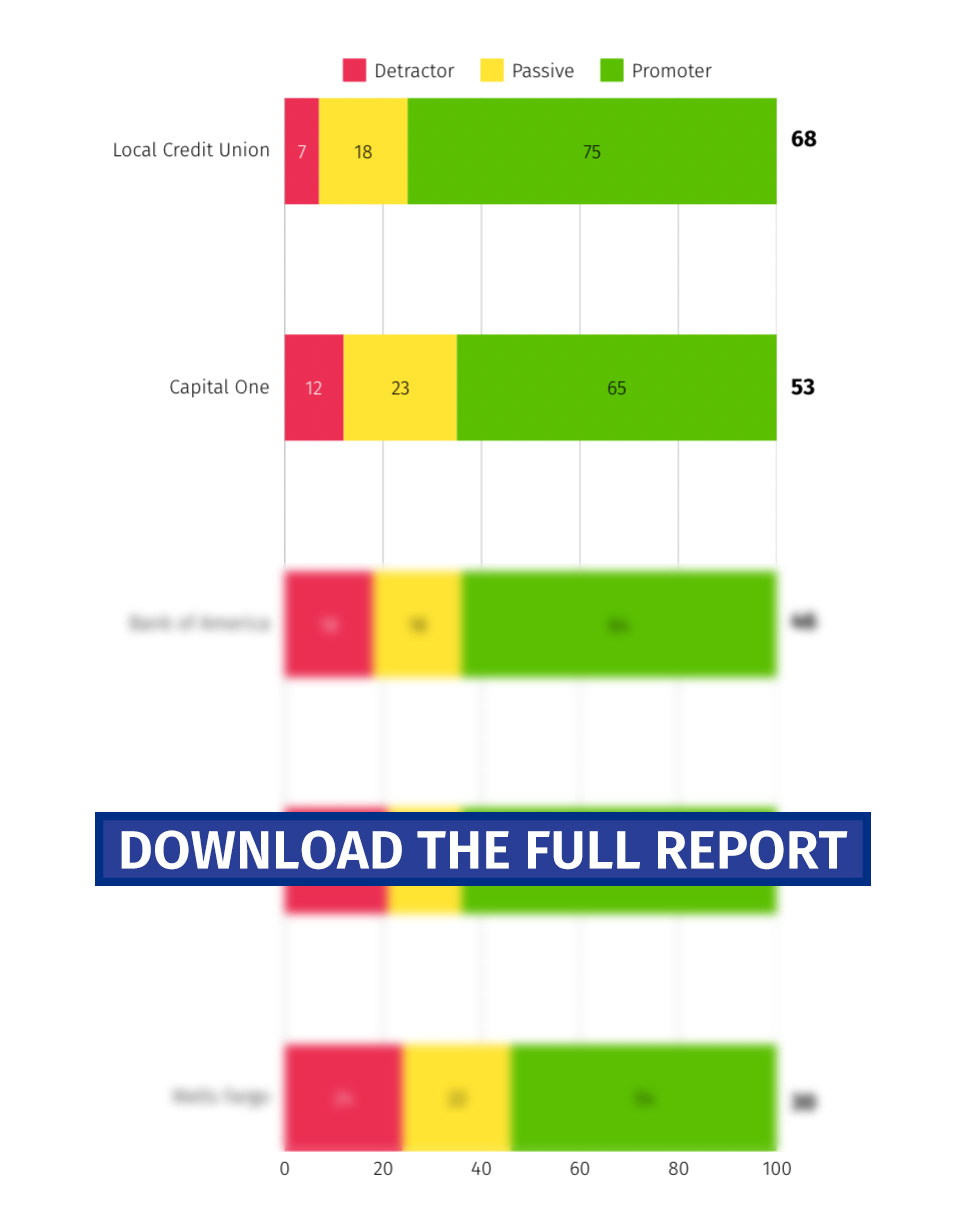

With an NPS of 43, JPMorgan Chase & Co. demonstrates solid customer loyalty. This score places it above many competitors in the banking sector, showcasing the company’s success in fostering long-term customer relationships. But what’s driving this loyalty?

The average NPS for the banking and financial services industry is 41. JPMorgan Chase & Co. outperforms the industry average by 2 points compared to this benchmark, reflecting slightly stronger customer sentiment than its competitors.

How Does Chase Compare to Industry Benchmarks?

Chase’s NPS of 43 is a competitive score. Many traditional banks struggle to surpass the 40-point threshold, while digital-only banks often score higher due to their ease of use and lower fees.

Chase’s physical presence combined with digital innovation gives it an edge, helping it maintain a strong customer base despite growing competition from fintech disruptors.

These insights are based on QuestionPro’s latest study, which surveyed 1,000 participants to calculate the NPS of various companies and industries. This report represents real user opinions from Q1 2025 and is updated quarterly.

JP Morgan Chase & Co Customer Testimonials

Customer reviews highlight why Chase earns a high NPS:

“I was promised a new debit card in 48 hours, and it arrived in 24. Now that’s customer service!”

(Reviews sourced from verified users on Trustpilot.)

“They monitor your accounts for fraud very well. The Freedom card helped me rebuild my credit history in just two months.”

“Whenever I need help, they always come through super quickly. Highly recommend!”

These testimonials show that key factors influencing customer perception include service quality, meeting and exceeding expectations, and offering real value products.

Why Customers Stay Loyal to Chase

JPMorgan Chase & Co. continues to innovate and expand, enhancing customer experience through:

- Chase Travel: A seamless way to book flights, hotels, and experiences.

- Financial Planning Tools: Credit score management and wealth planning resources.

- Branch Expansion: 166 new locations opened, with 500 more planned in the next three years.

Chase keeps customers engaged and committed by offering comprehensive financial services under one roof.

Want to Benchmark Your Own NPS?

Curious about how your business measures up? With QuestionPro Customer Experience, you can easily track and improve your NPS:

- Create a Survey: Use QuestionPro’s NPS survey template.

- Add a Net Promoter Score Question: Measure customer loyalty with a 0–10 scale response.

- Analyze Feedback: Use automated dashboards to uncover key trends.

- Take Action: Improve customer experience based on real insights.

Our platform provides all the tools you need to create outstanding experiences and establish yourself as an industry leader in customer satisfaction.

Need help optimizing your NPS strategy? QuestionPro Customer Experience offers a wide range of tools and platforms so you can not only measure your NPS, but also track satisfaction levels and collect feedback from your users at every point of contact. Keep control of your customer journey and improve your company’s satisfaction levels. Schedule a call now, and we’ll happily collaborate to achieve your goals.